Streamline your recruitment process with our recruitment and headhunting services. We manage everything from sourcing and screening candidates to final selection, making hiring a straightforward and effective process

Hire skilled IT professionals, software engineers, and technical experts with us. We source and match qualified candidates to meet your technical hiring needs across Pakistan, ensuring you get talent who fit your team’s requirements.

Our Executive Search services find and attract the best leadership talent, helping your business gain the expertise it needs. We manage every step of the hiring process to ensure a smooth and effective experience.

Payroll processing, tax calculations, compliance, and timely salary disbursements handled with precision. Our services cover everything from payslips to reporting, ensuring a smooth and error-free payroll process.

Global hiring, payroll, compliance, and tax management made simple with us EOR services. Expand without the need for a local entity while ensuring seamless onboarding and compliance for your international team

Improve workforce productivity and reduce costs through efficient HR outsourcing. Get expert support in managing compliance, payroll, recruitment, and other HR tasks, freeing up time for business growth.

Grow your team's skills with our practical corporate training programs focused on leadership development, technical skills, communication, and overall professional growth, designed to enhance performance and confidence.

Expert HR consultancy service to improve leadership skills, enhance team performance, and increase employee engagement. With our cost-effective, practical solutions that adapt to your business needs, we deliver real, results

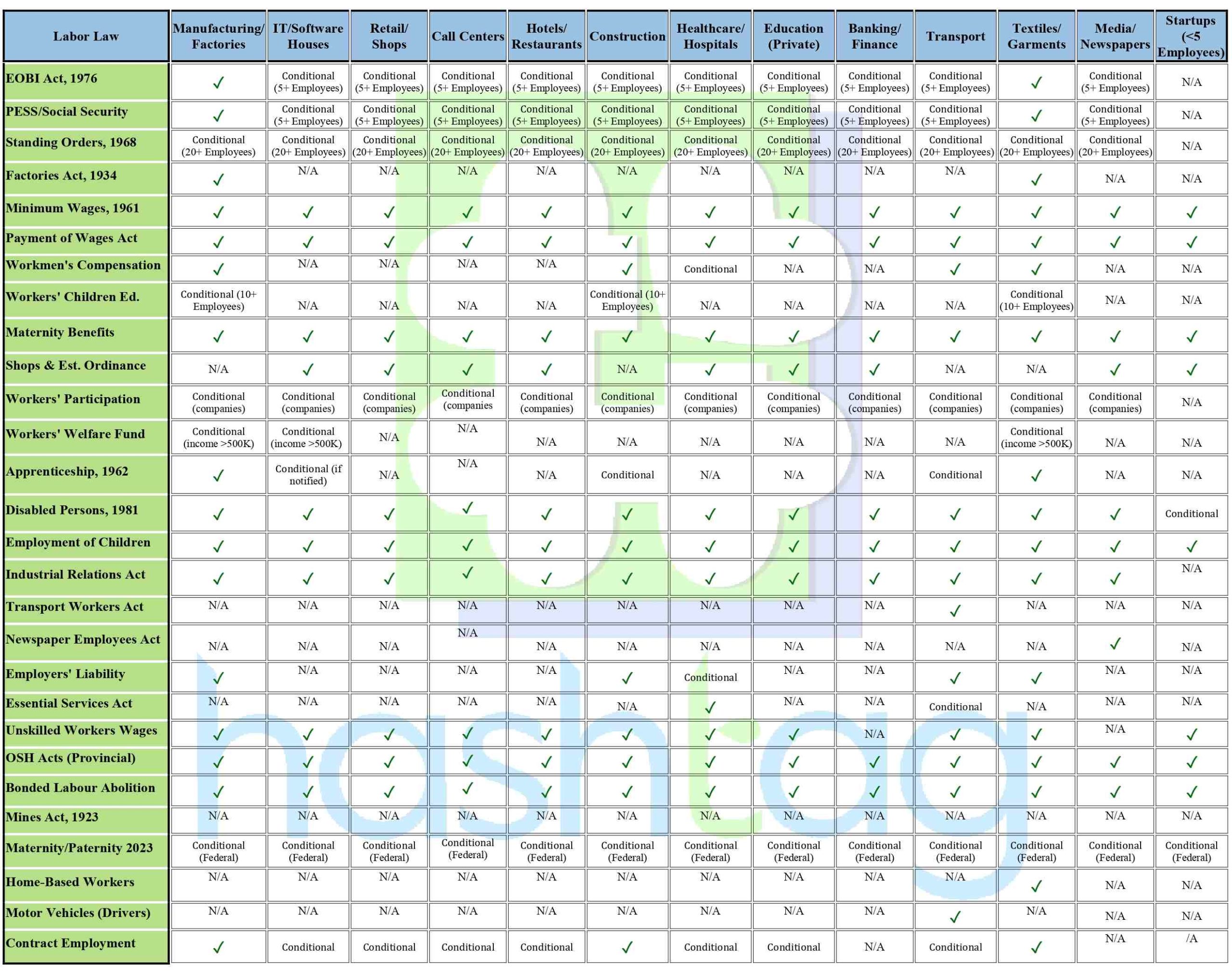

This comprehensive matrix shows which labor laws apply to different industries and sectors in Pakistan.

Use this to quickly identify your compliance obligations

HASHTAG is your trusted partner for top-tier payroll services in Pakistan, offering both Managed and SaaS (Software as a Service) solutions. Our steadfast commitment to delivering exceptional payroll solutions in Pakistan, combined with extensive industry experience, ensures accurate and compliant payroll services. Trust HASHTAG as your dedicated payroll provider in Pakistan, offering timely and precise transactions, including multi-currency payments tailored to the local market. With a team of in-country specialists well-versed in local laws, we provide comprehensive support for a seamless payroll experience aligned with your business needs.

HASHTAG is your trusted partner for top-tier payroll services in Pakistan, offering both Managed and SaaS (Software as a Service) solutions. Our steadfast commitment to delivering exceptional payroll solutions in Pakistan, combined with extensive industry experience, ensures accurate and compliant payroll services. Trust HASHTAG as your dedicated payroll provider in Pakistan, offering timely and precise transactions, including multi-currency payments tailored to the local market. With a team of in-country specialists well-versed in local laws, we provide comprehensive support for a seamless payroll experience aligned with your business needs.

Everything you need to know before running payroll in Pakistan

Working Hours and Overtime

In Pakistan, the standard workweek spans from Monday to Friday, with working hours typically from 9am to 6pm. While Friday is the official weekend day, certain industries may operate on Saturdays.

Employment laws mandate that the maximum weekly working hours should not exceed 48, with a daily limit of nine hours. Sundays are generally non-working days. During Ramadan, employees are expected to work six hours a day and 36 hours a week, excluding break times.

Employees working beyond regular hours or during weekends are entitled to overtime pay, calculated as their hourly wage plus an additional 50% of their monthly wage.

Here’s a summary of the working hour regulations:

• Workdays:

Monday to Friday, with Saturday and Sunday as the official weekend days.

• Weekly Working Hours:

Maximum of nine hours per day, with a one-hour break.

• Maximum Stay at Workplace:

12 hours per day.

• Ramadan Working Hours:

06 hours per day.

• Total Maximum Working Hours:

12 hours per day, including overtime.

Minimum Wages

Effective July 1, 2025, there has been an update to the minimum wages in Sindh, Pakistan. The national minimum wage for unskilled work has been increased from PKR 41,000 per month.

13th Month Salary

In Pakistan, there is no statutory obligation for employers to provide a 13th-month salary. However, companies with over 20 employees and profits are mandated to offer a bonus to employees with a tenure of at least 90 days.

Payroll Cycle

In Pakistan, employees receive payment at least once per month, with possible frequencies including daily, weekly, bi-monthly, or monthly.

Payroll Taxes in Pakistan

Social Security in Pakistan

The employer’s expenses are typically calculated within the range of 16.7-22.7%, plus additional fees based on the employee’s salary. Breakdown of contributions includes:

Sindh Employees’ Social Security Institution (SESSI) – 6.00%, applicable only for salaries below PKR 30,000.

Gratuity Fund Contribution – 8.33%

Life insurance – PKR 608

EOBI (Employee-Old-Age-Benefit) – PKR 1,250

Festival Bonus/13th Salary – 8.33%

It’s important to note that certain contributions may have limitations, leading to variations in percentages.

In Pakistan, specific laws have been established to safeguard employees’ rights, acknowledging the pivotal role of employee satisfaction in competitive market positioning. Employee benefits serve as motivational tools and contribute to enhancing work performance. These benefits fall into two broad categories:

Statutory benefits:

• Social Security

• Worker’s Compensation

• Gratuity

• Provident Fund

• Life Insurance

Discretionary benefits:

• Health Insurance

• Employee Training and Development

• Flexible Working Hours

Employee Benefits Laws in Pakistan:

• Workmen’s Compensation Act, 1923:

• Applicable to commercial businesses and industries.

• Mandatory for companies with ten or more employees, including railways, road transport services, and mining companies.

• Provincial Employees Social Security Ordinance, 1965:

• Covers full-time employees, daily wagers, and contract-based employees.

• Applies to industrial and commercial businesses with five or more workers.

• Excludes individuals in specific state services and those with wages exceeding defined thresholds.

• The Standing Orders Ordinance, 1968:

• Applicable to all industries and commercial businesses.

• Mandates for establishments with fifty or more employees.

• Social Security Law:

• Provides compensation for loss of earning capacity.

• Replacement earnings offered based on the degree of incapacitation.

• Employee Social Security (Benefit) Regulations, 1967:

• Ensures financial support for individuals facing earning capacity loss.

• Pakistan Compensation Laws:

• Mandates a minimum wage for unskilled employees.

• Requires profit bonuses for businesses with 20 or more workers.

Types of Employee Benefits in Pakistan:

• Injuries and Disabilities:

o Compensation for workplace injuries.

o Enhanced compensation in case of severe disabilities or death.

• Sickness:

o Sickness benefits for employees with qualifying contributions.

• Maternity:

o Maternity benefits for eligible female employees.

• Death:

o Benefits for survivors of deceased insured workers.

• Medical:

o Medical benefits coverage for employees and their dependents.

• Benefits to Survivors:

o Pension benefits for dependents of deceased workers.

Guaranteed Benefits:

• Holidays and paid vacations.

• National and religious holidays.

• Casual and medical leave entitlements.

Calculating Employee Benefits:

• Various criteria determine benefit calculations as per Pakistan’s labor laws, including annual vacations, sick leaves, old age benefits, and social security benefits.

• Achieving Compliance with Complex Regulations: Outsourcing payroll services in Pakistan ensures meticulous adherence to intricate labor laws and regulations. Our expert professionals adeptly navigate these complexities, minimizing the risk of errors or penalties due to non-compliance, providing peace of mind for businesses.

• Enhancing Scalability and Flexibility: Payroll outsourcing offers unparalleled scalability and flexibility to meet the evolving needs of businesses in Pakistan. Whether expanding the workforce or adapting to changes in employment regulations, outsourcing providers seamlessly adjust their services to meet these demands.

• Access to Advanced Technologies and Expertise: Leveraging cutting-edge software solutions, outsourcing providers streamline processes, enhance data security, and improve efficiency in payroll management in Pakistan. Additionally, professionals possess extensive knowledge of tax regulations, deductions, and reporting requirements, ensuring accurate and timely processing.

• Cost Savings and Competitive Pricing: Outsourcing payroll leads to significant cost savings by eliminating the need to hire and train in-house staff. Furthermore, providers often offer competitive pricing models tailored to the specific needs of businesses, optimizing cost-effectiveness while maintaining quality service.

• Supporting Business Growth: Overall, outsourcing payroll services in Pakistan enables businesses to focus on core objectives while benefiting from accurate, compliant, and cost-effective management. With specialized expertise, advanced technologies, and scalability, providers play a crucial role in supporting the growth and success of businesses.

• Emphasizing High Safety Standards: Incorporating industry-leading security measures to safeguard sensitive data, along with ISO 27001 and ISAE3402 certifications, ensures stringent adherence to information security protocols.

• Ensuring Adequate and Sustainable Performance: Our commitment extends to ensuring consistent and sustainable performance that meets the dynamic demands of payroll services in Pakistan.

• Flexibility and Scalability Tailored to You: We offer flexibility and scalability to accommodate evolving client needs and adapt to changing business environments in Pakistan.

• Utilizing Collaborative Cloud Tools: Our collaborative Cloud-based platform promotes efficiency and accessibility across teams, facilitating seamless collaboration and communication. These certifications signify our commitment to the highest standards of information security and operational integrity.

Cut HR costs with our cost-effective HR solutions, designed to maximize efficiency and savings. Invest in what drives your business while we handle your HR processes.

Our services adapt to your changing needs as you expand. Get the right HR support at every stage of your business journey.

Our data-driven HR market intelligence helps you to make informed decisions, stay ahead in the competitive market, and optimize your workforce strategies.

Our strategies improve team efficiency and performance. Achieve more with optimized HR processes and motivated employees

HR and payroll services manage employee-related tasks like recruitment, benefits, compliance, and payroll processing, ensuring accurate, timely payments and adherence to labor laws.

Managing HR and payroll is a vital part of running a successful business, ensuring everything from employee well-being to timely salary payments runs smoothly. HR and payroll services cover a wide range of tasks, including occupational health and safety (OHS), preparing essential HR and payroll documents, processing salary settlements, maintaining accurate employee records, managing leave requests, and streamlining employee recruitment.

Many businesses today choose HR and payroll outsourcing to simplify these processes. By partnering with external HR and payroll service providers, companies can delegate some or all of these tasks to experts. While outsourcing offers benefits like cost savings and efficiency, it also comes with potential challenges. In this article, we’ll dive into what HR and payroll services entail, exploring their scope and key components to help you understand how they support your business

Comprehensive HR and payroll services include all activities related to human resources and payroll. The scope depends on the specific nature of the business.

It’s important not to confuse HR and payroll services with HR and payroll outsourcing. The former refers to specific actions performed by the HR and payroll department, while the latter involves outsourcing these activities to an external entity.

As the name suggests, HR and payroll services consist of two parts: HR services and payroll services, encompassing activities in both areas.

HR Services

HR services (HR outsourcing) include activities such as:

• Recruitment and downsizing of employees;

• Maintaining personal records;

• Creating employment contracts;

• OHS services — including organizing training;

• Human resources management — schedules, leaves, dismissals;

• Supervision and verification of labor law compliance.

Payroll Services

Payroll services include:

• Preparing payroll lists;

• Calculating salaries;

• Computing social security contributions.

• Preparing tax declarations for income tax.

• Salary payments;

• Preparing financial reports.

When you outsource HR functions like payroll, compliance, onboarding, and administration to us, you gain a dedicated team that monitors changing local labor laws, handles sensitive payroll data securely, and ensures error-free compliance filings. This reduces the risk of penalties, unexpected costs, and employee disputes. With us, you get predictable HR support backed by local expertise and proactive issue resolution, so your business can operate with stability and confidence.

In addition to the basic elements of any agreement, such as the parties’ details, the date of conclusion, and the duration, an agreement regarding HR and payroll outsourcing should include the following points:,

• Duties of the HR and payroll department (responsibilities of the contractor);

• Duties of the client (customer responsibilities);

• Liability for damages;

• Remuneration amount.

We provides complete HR solutions in Pakistan, including recruitment services for all levels, executive search for senior leadership roles, HR outsourcing, onboarding support, payroll outsourcing, and Employer of Record services. By covering the full HR cycle, we helps businesses avoid compliance mistakes, reduce operational costs, and focus on growth without needing to build large internal HR teams