Bookkeeping is the process of systematically recording, organizing, and maintaining a business’s financial transactions. It is the foundation of accounting and ensures that all financial information is accurate, up-to-date, and accessible for analysis, reporting, and decision-making.

Bookkeeping is broadly categorized into two types based on how transactions are recorded:

Single-Entry Bookkeeping:

In this system, each transaction is recorded only once, either as an income or an expense.

It is simpler and often used by small businesses or individuals.

Example: A cash sale of Rs. 5,000 would be recorded as an increase in cash without any corresponding account entry.

Double-Entry Bookkeeping:

Every transaction is recorded in two accounts: one as a debit and the other as a credit.

Our financial and record management services have assisted numerous clients over the years. We understand how to meet your unique requirements effectively. Fortunately, we have established ourselves as a leading provider in this field. Our specialized services have consistently delivered results for countless businesses.

With our financial and record management solutions, your business can achieve unparalleled success. We are dedicated to offering the finest services tailored to your needs. Furthermore, we go above and beyond to ensure your complete satisfaction. A reputable company like ours can address all your financial and record-keeping needs under one roof.

Our services are not limited to short-term solutions. Instead, we have crafted our offerings to manage your company’s financial and record-keeping needs for the long term.

Feel free to explore our range of services. We are always ready to assist you and adjust our pricing to fit your budget.

In both types of bookkeeping, the following accounts are commonly used:

1. Assets:

Resources owned by the business (e.g., cash, inventory, equipment).

2. Liabilities:

Debts or obligations (e.g., loans, accounts payable).

3. Equity:

The owner's claim on the business after liabilities are subtracted.

Our services are customized for each type of businesses. You can contact us to get the quote according to your needs and requirements.

Frequently asked question (FAQ)pages to find answars.

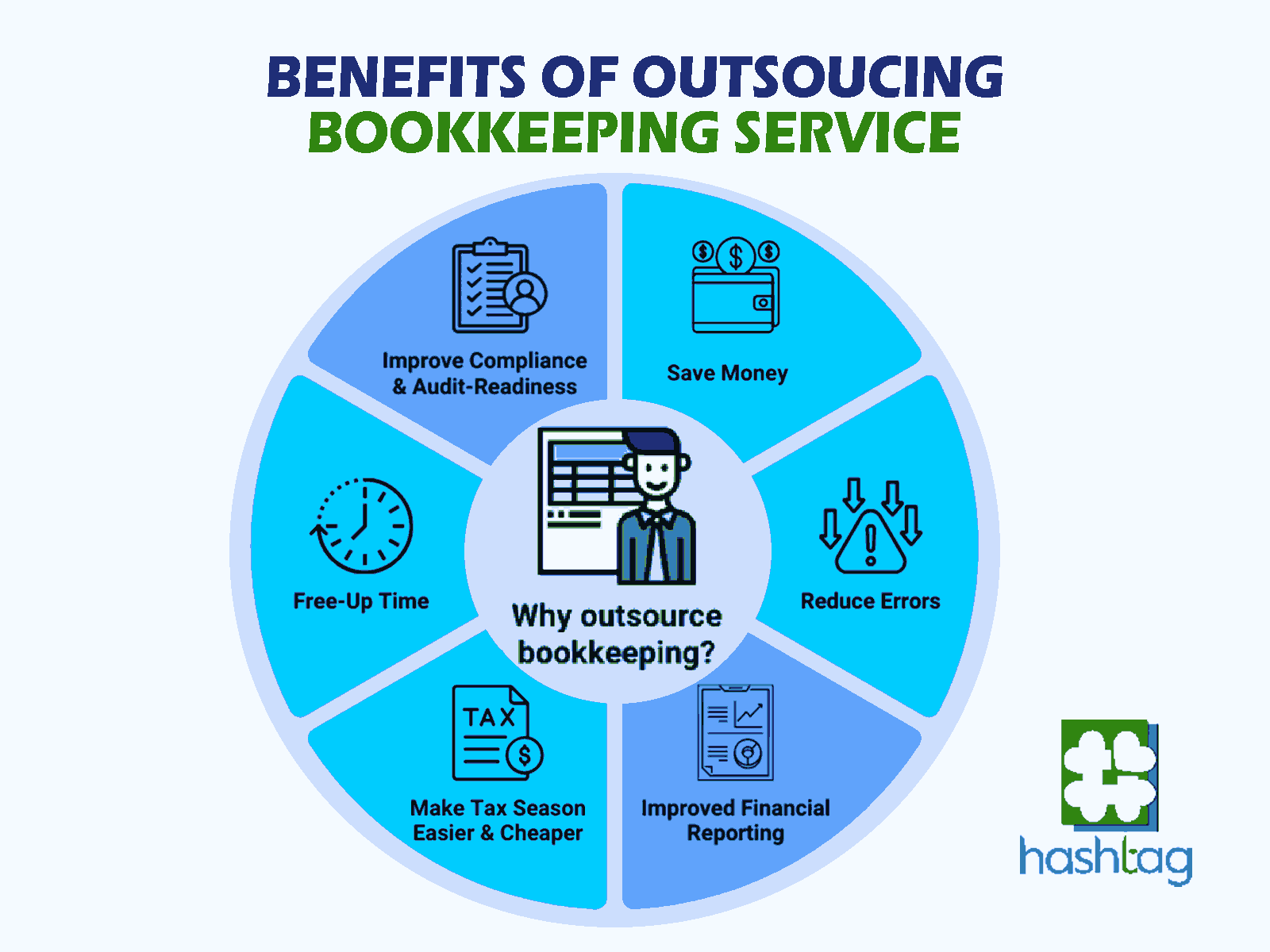

If you’ve recently launched as a new business or are managing a small enterprise, hiring a full-time employee for your bookkeeping and accounting tasks may not be necessary. In such situations, opting for an outsourced bookkeeper is an ideal solution. This approach can help you save on the costs of maintaining a full-time accountant or an entire accounting department, while also sparing you the time and effort required to handle these tasks yourself. Additionally, you won’t need to cover expenses like paid vacations, leaves, or payroll taxes for an outsourced provider. All your essential bookkeeping will be completed accurately and on schedule, including tax preparation to ensure compliance with the FBR. Reach out to us to explore how your organization can benefit from outsourcing fundamental accounting functions.

As a business owner, managing your own bookkeeping is often seen as an unnecessary task. Why waste your valuable time on bookkeeping when you can focus entirely on growing and developing your business? Instead, hire us as your top bookkeeping service in Pakistan. We offer more than just organizing your financial records. We track cash flows and time-sensitive transactions to ensure your business never faces financial difficulties. We identify any gaps in your accounting processes to enhance development and asset management. Our team conducts detailed financial analyses to help you understand your business performance, enabling you to make informed decisions for your business in Pakistan. By outsourcing to us, your clients can dedicate more time to core business activities, including revenue-generating functions. Hashtag offers the best bookkeeping and accounting packages in Pakistan, ensuring proper record-keeping and FBR tax filing. We also handle quarterly payroll taxes and annual filings for vendors, providing top-tier tax bookkeeping services in Pakistan.

Outsourcing bookkeeping services offers numerous advantages for individuals in Pakistan. Accurate bookkeeping helps individuals prepare and file their taxes according to FBR regulations, ensuring timely submissions. Hashtag’s bookkeeping services allow individuals to file crucial FBR tax forms accurately, simplifying the return filing process. Personal bookkeeping services also assist in financial and investment planning, along with effective asset management. These services are ideal for individuals unfamiliar with current government laws and accounting procedures. Reach out to our team to discover how bookkeeping can benefit individuals in Pakistan.

Outsourcing bookkeeping services is particularly advantageous for small and medium-sized businesses due to its cost-effectiveness and time-saving benefits. Business owners can access all financial and accounting data securely from any device, ensuring privacy and data protection. We provide dependable online bookkeeping services for businesses. Contact us to outsource precise accounting services from one of the most affordable and top-rated bookkeeping service providers.

"Without strong accounting practices, your business risks making poorly informed decisions. These decisions can pose a significant threat to all stakeholders connected to the company. Accurate and timely information brings clarity, and with clarity, true vision becomes achievable.

You can proceed with confidence, assured that your decisions are grounded in a reliable foundation of precision.

We ensures that the accounting and bookkeeping services we provide will offer the clarity necessary for you to make the right choices to drive your business toward success."