Finance vs Accounting:

Key Differences You Need to Know

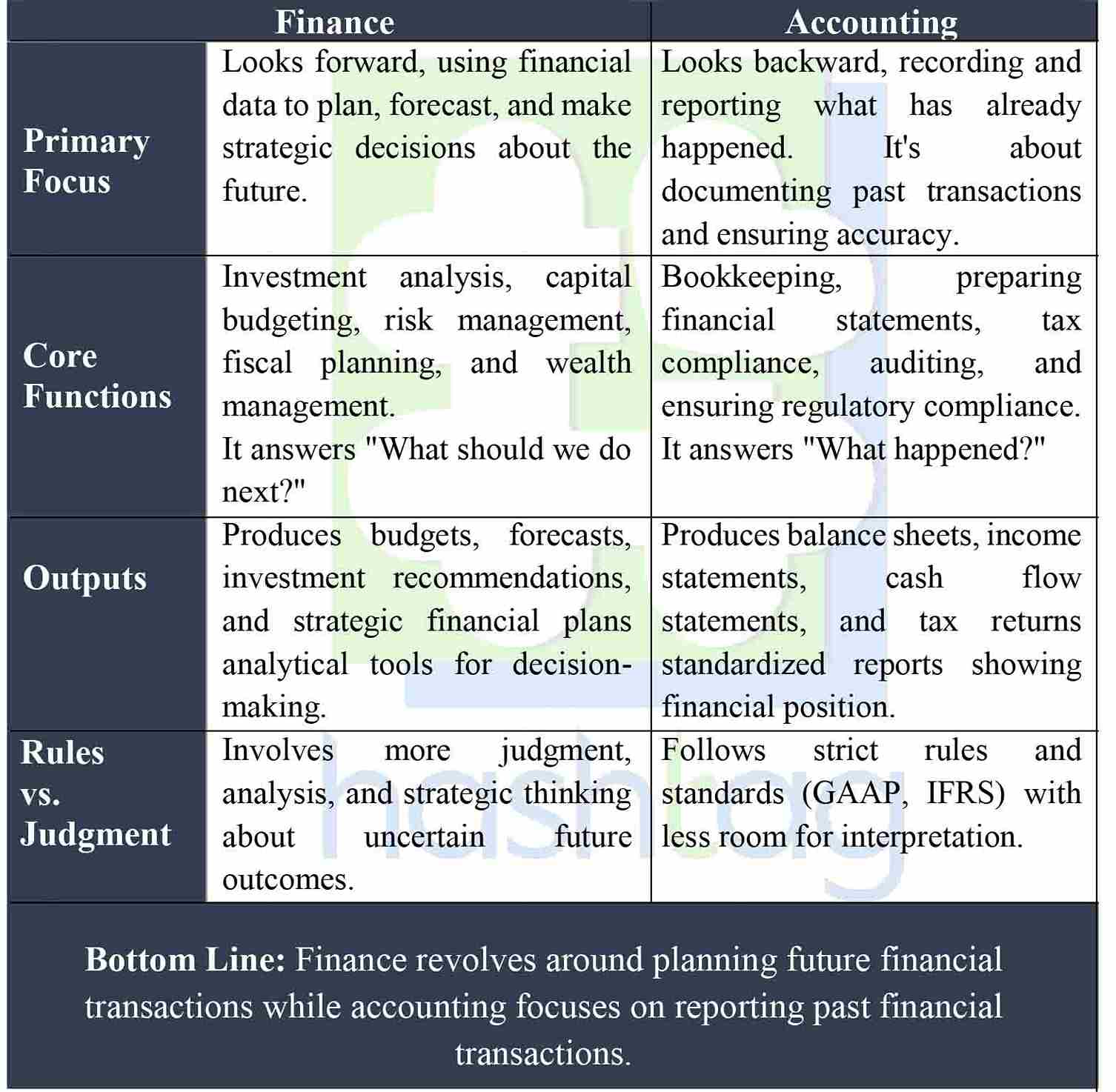

Finance focuses on the future transactions while Accounting reports on the past transactions.

Financial experts

(wealth managers, asset allocators, capital markets specialists) typically focus on raising capital (funds) and deploying it to expand an organization’s assets for long-term gains. They guarantee that an enterprise maintains sufficient liquidity to sustain operations ahead by applying strategies like lending, reserving, and allocating resources.

Bookkeeping, in contrast, primarily reviews history, with bookkeeping specialists monitoring, documenting, and evaluating monetary activities within a firm. This involves logging an entity’s fund movements, updating financial records, and disclosing profits and deficits, thereby confirming that prior occurrences are captured precisely.

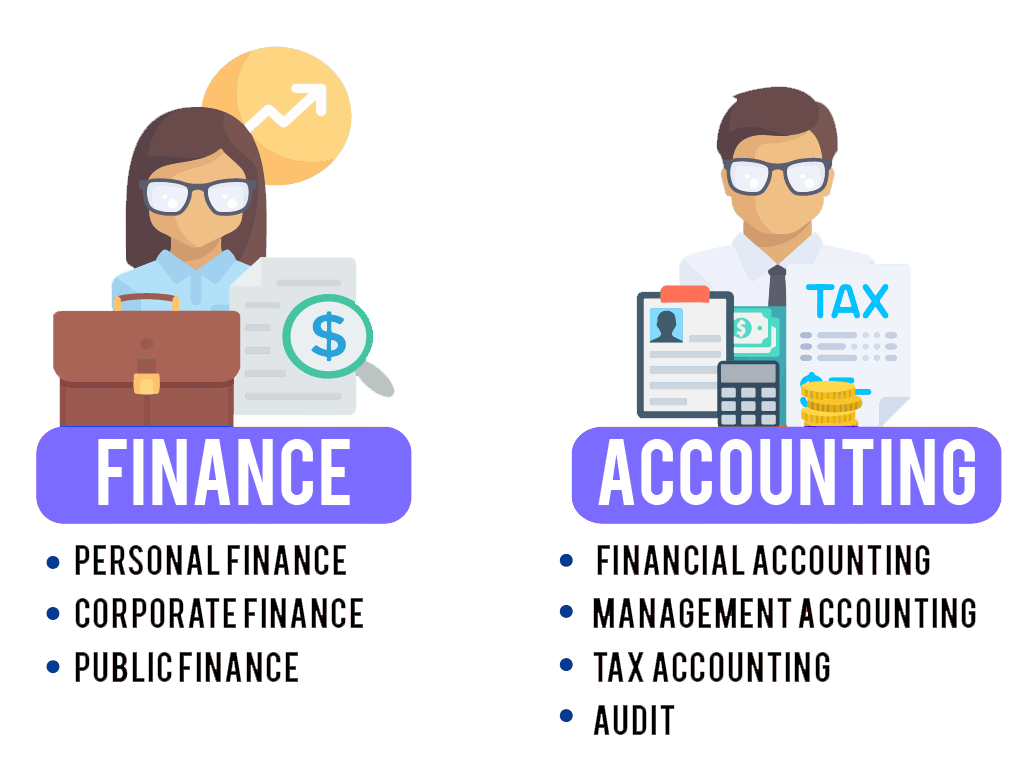

Both have different branches

Generally, there are 3 main areas of finance Personal finance, corporate finance and Public finance.

Personal finance

Relates to financial decisions that will affect an individual. Common areas include funding schooling, building investments and retirement savings, shielding against unexpected risks (like buying insurance), and estate setup (such as drafting a will for after death).

Roles in the personal finance industry include financial planner and relationship or private wealth manager.

Corporate finance

Centers on a company’s financial outlook and aims to boost business value, such as spotting cheap assets to buy, securing loans or debt for operations, and evaluating firms for mergers or takeovers.

Positions here include trader, financial analyst, credit specialist, investment banker, and portfolio manager.

Public finance

Deals with handling funds at government, state, or state-affiliated bodies (e.g., Finance Ministry, Meezan Bank, Employees Provident Fund (EPF)). It focuses on long-term choices to create public benefit.

Careers in public finance include valuation specialist, investment operations officer, and debt/equity research analyst.

ON THE OTHER HAND, THE KEY AREAS OF ACCOUNTING ARE:

- Financial Accounting

- Management Accounting,

- Tax Accounting

- Audit & Assurance Services.

Financial accounting

Enables companies to monitor their complete financial well-being through the creation of comprehensive summaries of an organization’s monetary activities. Key duties involve documenting economic exchanges and compiling statements (such as cash flow reports, income statements, statements of financial position and Balance sheet).

Typical roles in this field include accounts officer, accounts expert (payable/receivable), and ledger keeper.

Management accounting

Concentrates on preparing and examining monetary data to assist organizations in making informed choices that align with strategic aims and targets. Core responsibilities encompass revenue projection, budget preparation, expense distribution, and return-on-investment evaluation.

Positions in this area include cost accountant, budget planner, and finance director.

Tax accounting

Centers on accounting practices tailored for taxation compliance. It is regulated by the standards established by the Federal Board of Revenue (FBR) Pakistan and, in certain instances, provincial authorities, which outline mandatory procedures for individuals and entities during tax submissions.

Career paths in tax accounting include tax advisor and Income Tax Practitioner.

Auditing & assurance services

Reviews an entity’s financial documentation to verify adherence to established accounting principles. Auditors assess the reliability of monetary dealings via techniques like witnessing stocktaking, examining bills and disbursements, and investigating discrepancies in ledger balances.

Roles in auditing include external auditor and internal review specialist.

Bottom line: Finance covers personal finance, corporate finance and public finance. Accounting areas consist of financial accounting, management accounting, tax accounting and audit.

Your potential companies can vary significantly depending on your chosen field.

As a finance graduate, you can target your job search to investment companies licensed by the Securities and Exchange Commission of Pakistan (SECP) (e.g. Arif Habib Limited, ABL Asset Management Company Limited, Securities Investment Company Limited), Islamic and conventional banks (Meezan Bank Limited, Standard Chartered Bank (Pakistan) Limited, Habib Bank Limited) etc.

With accounting, most graduates would seek employment in the largest accounting firms operating in Pakistan under the oversight of the Institute of Chartered Accountants of Pakistan (ICAP) and the Institute of Cost and Management Accountants of Pakistan (ICMA Pakistan), namely Deloitte Pakistan, PricewaterhouseCoopers (PwC) Pakistan, Ernst & Young (EY) Pakistan and KPMG Taseer Hadi & Co. In addition to these firms, numerous companies registered with SECP also require the services of an accountant.

It is worth noting that all companies, large or small, need accounting professionals in compliance with the Companies Act, 2017 and International Financial Reporting Standards (IFRS) as adopted in Pakistan, whereas not every company will require a finance professional. This means that your employment options can be much wider as an accounting graduate.

Each field has its own professional qualifications recognized under Pakistani laws

If you’re a finance graduate, you can pursue professional qualifications such as Chartered Financial Analyst (CFA) offered by CFA Institute USA (recognized by SECP for investment advisory roles), Certified Financial Planner (CFP) and Registered Financial Planner (RFP) where applicable under local regulatory frameworks.

On the other hand, if you plan on pursuing a professional qualification in the accountancy field, you can be accredited by a number of professional bodies recognized by the SECP and the Auditor Oversight Board of Pakistan, such as the Association of Chartered Certified Accountants (ACCA), Chartered Institute of Management Accountants (CIMA) and Institute of Chartered Accountants of Pakistan (ICAP) the statutory body established under the Chartered Accountants Ordinance, 1961.